Welcome to the Quincy Assessors website! Whether you are a homeowner, a real estate professional, or just curious about how taxes are assessed, this website is the go-to place for understanding property tax assessment in the City of Quincy.

What does an assessor do?

In general, assessors have two main jobs – they determine the value of taxable real and personal property in their jurisdiction and they calculate the tax owed on each property based on the prevailing property tax rates. In Massachusetts, Chapters 59, 60A, 61, 61B, 121A of the Massachusetts General Laws and various Acts of the Legislature set the laws and regulations that assessors follow in doing their job. These laws and regulations specify that in addition to overseeing property taxes, assessors are responsible for administering excise taxes on motor vehicles and boats.

Quincy’s assessors appraise approximately 27,000 parcels of property in Quincy (residential, commercial, industrial, utilities, and personal property) and process over 74,000 motor vehicle and boat excise tax bills annually.

Quincy’s assessors appraise approximately 27,000 parcels of property in Quincy (residential, commercial, industrial, utilities, and personal property) and process over 74,000 motor vehicle and boat excise tax bills annually.

Explanation video about the property valuation process in the City of Quincy.

Access the English transcription here or the Chinese transcription here.

Access the English transcription here or the Chinese transcription here.

Understanding Your Taxes

The Assessors Department has worked diligently this fall to create the publication "Understanding Your Taxes". We hope this informative booklet will educate the taxpayer on all components that go into determining property taxes from beginning to end.

We welcome you to contact our office at any time if you have questions related to the booklet.

We welcome you to contact our office at any time if you have questions related to the booklet.

Tax Rates

| Fiscal Year | Residential Tax Rate | Commercial Tax Rate |

| 2026 | $11.78 / $1,000 of assessed value | $23.53 / $1,000 of assessed value |

| 2025 | $11.53 / $1,000 of assessed value | $23.01 / $1,000 of assessed value |

| 2024 | $11.27 / $1,000 of assessed value | $22.45 / $1,000 of assessed value |

Excise Taxes

The assessor oversees excise taxes on motor vehicles and boats; if you own a motor vehicle or a boat, you must pay an excise tax. Excise taxes are charged annually and are determined based on the value of your vehicle or boat.

Motor Vehicle

Motor vehicle excise must be paid annually. The tax is calculated based on the value of your vehicle.

Boat Excise

Boat excise must be paid annually. The amount of the tax is based on the value of your boat.

Exemption Programs

Property tax exemptions, as approved by state law, can reduce or eliminate tax obligations for eligible taxpayers. Applications for exemptions must be filed each year; all applications for fiscal year 2024 are due on or before April 3, 2024.

Exemption Programs

As approved by state law, the Board of Assessors administers tax assistance programs for various eligible taxpayers. All applications for fiscal year 2023 are due on or before April 3, 2023. Applications for exemptions must be filed each year.

Senior Citizens 65+

Legally Blind Property Owners

Widows, Widowers, and Minor Children of a Deceased Parent

Police Officer and Firefighter Spouses

Veterans

Real Estate Tax Abatement

.png)

What is an abatement?

Abatements lower property value and taxes after the assessor corrects inaccurate information or adjusts the assessed value based on evidence showing errors.

Who files an abatement?

In most cases, those who can file an abatement include: the homeowner, a personal representative with a valid power of attorney, and a designated trustee for a property-owning trust.

Deadlines Are Important

Deadlines are critical. You have from January 1st to February 1st to file an abatement. If February 1st falls on the weekend, you can file the following Monday. By law, the assessors must deny late filings.

Click the Learn More button to see if it makes sense to file an abatement.

Real Estate Tax Abatement

.png)

What is an abatement?

Abatements lower property value and taxes after the assessor corrects inaccurate information or adjusts the assessed value based on evidence showing errors.

Deadlines Are Important

Deadlines are critical. You have from January 1st to February 1st to file an abatement. If February 1st falls on the weekend, you can file the following Monday. Late filings will be denied by law.

Who Files An Abatement?

In most cases, those who can file an abatement include: The homeowner, a personal representative with a valid power of attorney and a designated trustee for a property-owning trust.

Accurate property data and sales of comparable properties are essential to property valuation. The good news is that you have access to the same data as the assessor. Click Learn More below to see if it makes sense to file an abatement.

Property Inspections

Property inspections are essential to ensuring fair property valuations and accurate assessments. Learn about the inspection process, meet our data collectors, and read about how assessors use property data.

Thank you for helping us ensure equitable property values.

Thank you for helping us ensure equitable property values.

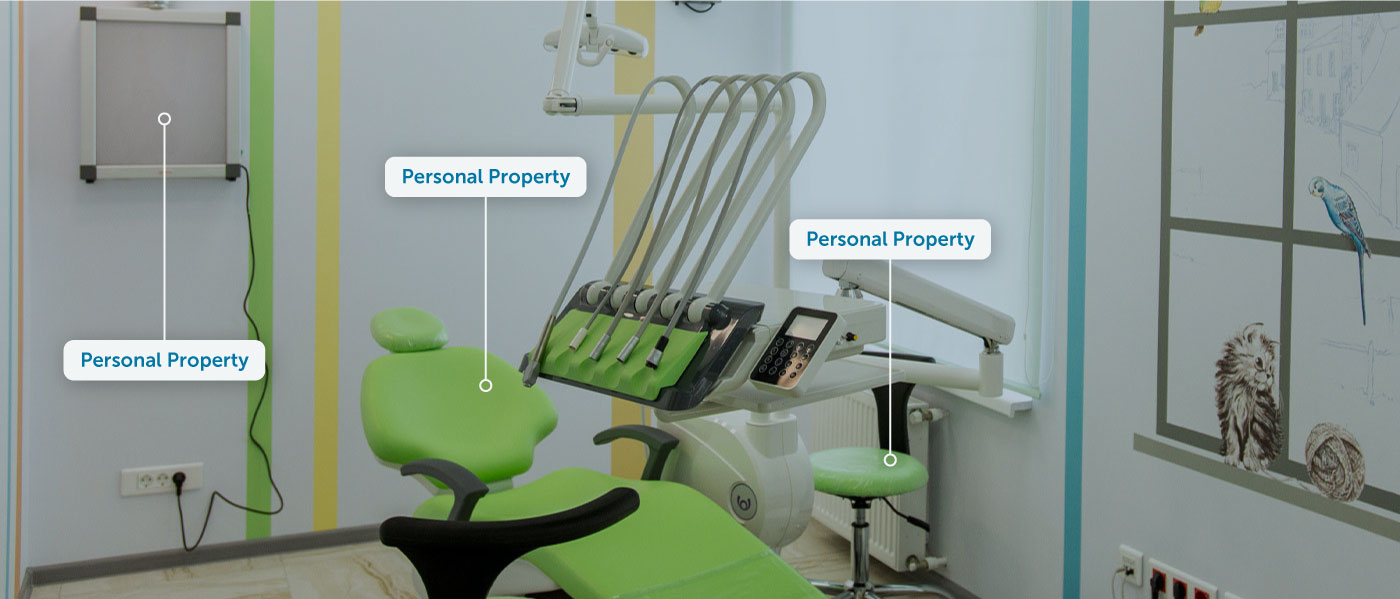

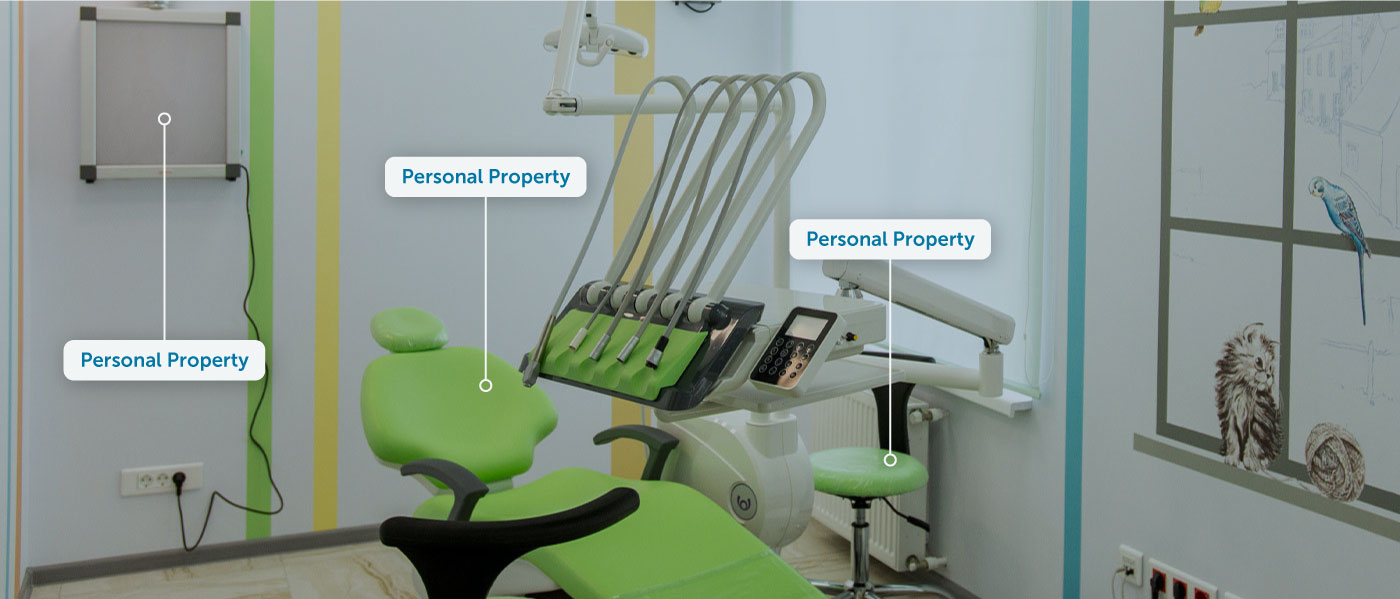

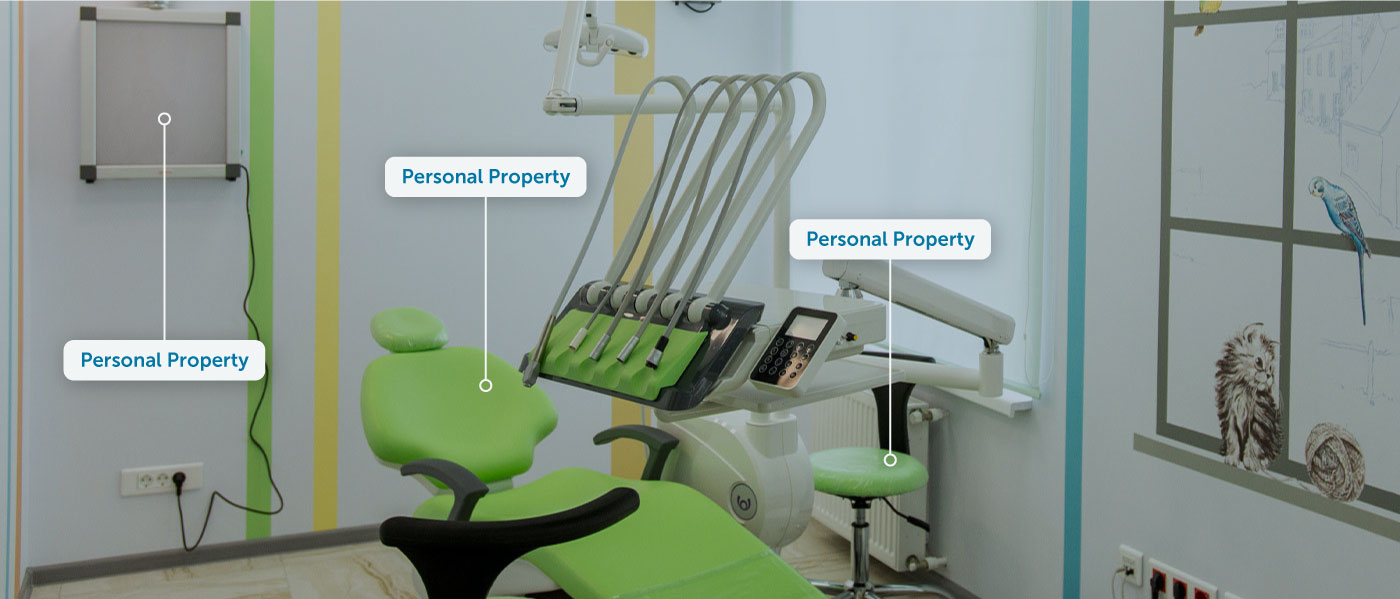

Personal Property Tax

Personal property is assessed separately from real estate and consists of “tangible” assets, goods and material objects used in the conduct of business. In Massachusetts, any business active as of January 1 in a given year is subject to personal property tax and billed for the entire year by the municipality they reside in on that date.

Office Room

Dentist Room

Auto Repair Shop

Personal property examples: furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc.

Personal property examples: furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc. Personal property examples: furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc.

Personal property examples: furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc. Personal property examples: furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc.

Personal property examples: furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc.Personal Property Tax

Personal property is “tangible” property. That means the property physically exists. Personal property is assets, goods and material objects used in the conduct of a business and is assessed separately from real estate. Any business that existed on that date is subject to personal property tax and will be billed for the entire fiscal year. This applies to businesses that have closed or relocated after the assessment date. Personal property tax is not prorated per Massachusetts General Law.

Office Room

Personal Property: Furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc.

Dentist Room

Personal Property: Furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc.

Auto Repair Shop

Personal Property: Furniture, furnishings, fixtures, equipment, appliances, supplies, machinery etc.