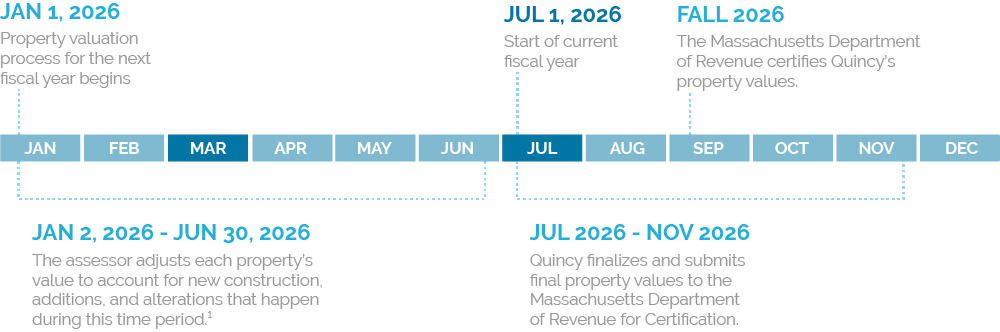

Valuation Timeline

1. Massachusetts General Law, Chapter 59, § 2A(a)

This law allows cities and towns to assess new buildings, structures, or other physical improvements added to real property between January 2 and June 30 for the fiscal year beginning on July 1. As a result, new construction or improvements built on the parcel during the first six months of the year will now be reflected in the assessed valuation of the parcel a fiscal year earlier. However, the statute does not change the January 1 assessment date. The taxable unit, ownership, and value of real estate parcels will still be determined as of January 1. The assessment of personal property is not affected by this legislation.

This law allows cities and towns to assess new buildings, structures, or other physical improvements added to real property between January 2 and June 30 for the fiscal year beginning on July 1. As a result, new construction or improvements built on the parcel during the first six months of the year will now be reflected in the assessed valuation of the parcel a fiscal year earlier. However, the statute does not change the January 1 assessment date. The taxable unit, ownership, and value of real estate parcels will still be determined as of January 1. The assessment of personal property is not affected by this legislation.

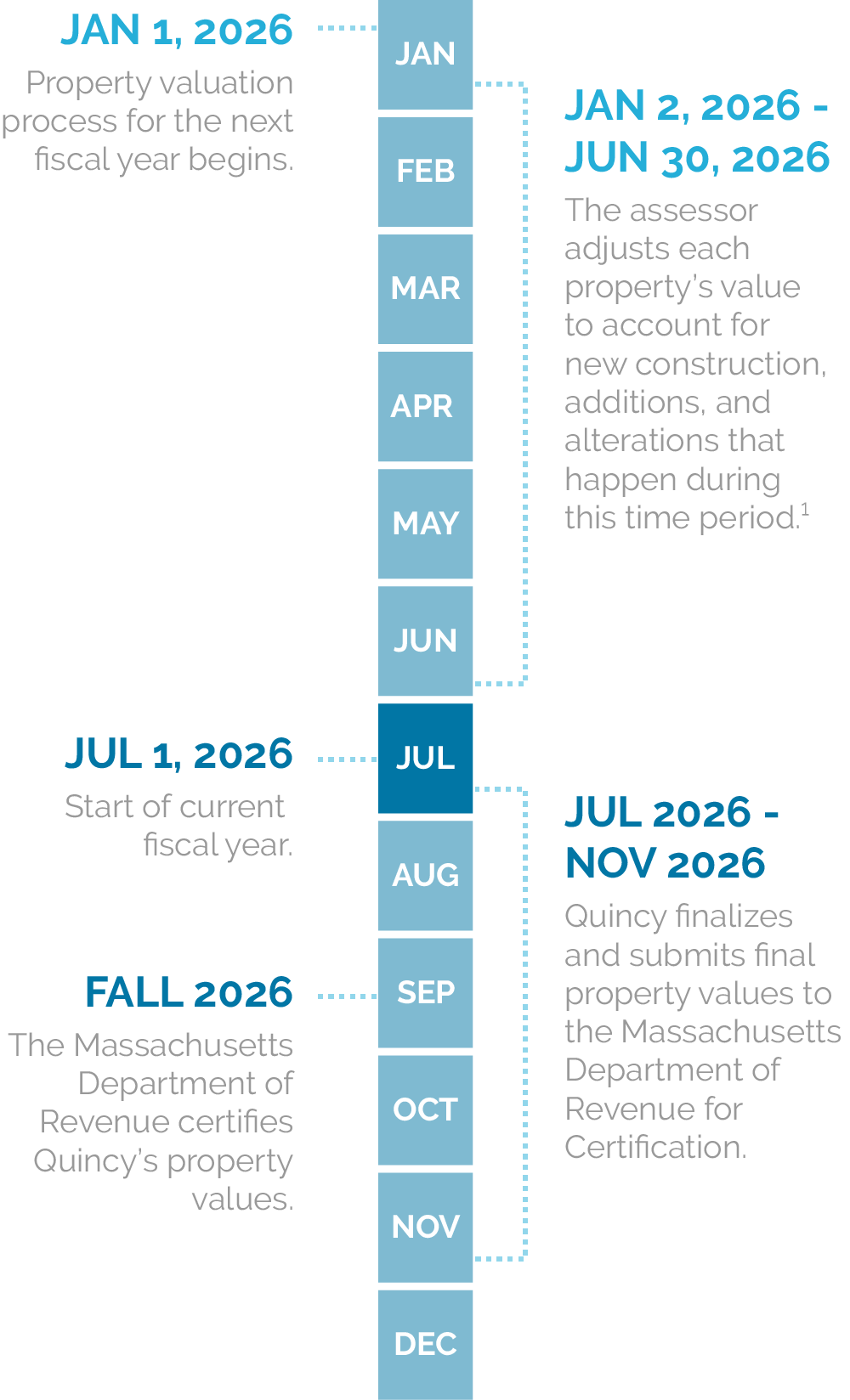

Valuation Timeline

1. Massachusetts General Law, Chapter 59, § 2A(a)

This law allows cities and towns to assess new buildings, structures, or other physical improvements added to real property between January 2 and June 30 for the fiscal year beginning on July 1. As a result, new construction or improvements built on the parcel during the first six months of the year will now be reflected in the assessed valuation of the parcel a fiscal year earlier. However, the statute does not change the January 1 assessment date. The taxable unit, ownership, and value of real estate parcels will still be determined as of January 1. The assessment of personal property is not affected by this legislation.

This law allows cities and towns to assess new buildings, structures, or other physical improvements added to real property between January 2 and June 30 for the fiscal year beginning on July 1. As a result, new construction or improvements built on the parcel during the first six months of the year will now be reflected in the assessed valuation of the parcel a fiscal year earlier. However, the statute does not change the January 1 assessment date. The taxable unit, ownership, and value of real estate parcels will still be determined as of January 1. The assessment of personal property is not affected by this legislation.

Property: Real and Personal

Like all municipalities, Quincy depends on both real and personal property taxes to fund its budget. Understanding the taxation process begins with understanding what real property and personal property are.

PROPERTY CLASSIFICATION

The assessor’s job starts by determining if property is real or personal. State law requires that the assessor further classify real property into one of four categories depending on property use. The four real property use categories are: residential, commercial, industrial, or open space. In Quincy there are only residential, commercial, and industrial properties.

Property classification allows the assessor to choose the best valuation methods to value a particular property and enables the fair and equitable distribution of the tax burden.

Real

Residential

Real property used/held for housing purposes.

Industrial

Real property used/held for manufacturing, milling, converting, producing, and processing.

Commercial

Real property used/held for non-industrial business purposes.

Personal

Personal Property

All tangible, non-real estate assets owned by an individual, a business, or an organization.

Property Valuation Process

After classification, the assessor works to determine the property’s full and fair cash value, the price a willing seller and a willing buyer would agree to in an “arm’s-length” transaction. By determining each property’s full and fair cash value, Quincy ensures that property owners pay only their fair share of the City’s tax burden.

Property valuation can be thought of in two distinct phases - data collection and valuation and analysis. Once the Department of Revenue certifies the property values, the assessor calculates the final property taxes each property owner owes; the third quarter and fourth quarter property tax bills contain the final property value and final taxes owed. To learn more about property tax calculation, please see “How Property Taxes Are Calculated For Individual Properties” (page 12) in the Understanding Your Taxes brochure.

Learn More About Valuation

To learn more about real and personal property taxes, check out page 5 of the Understanding Your Taxes brochure. This informative guide explains the calculation of taxes and highlights their significance for the City of Quincy.

Property Valuation Process

After classification, the assessor shifts their focus determining the property’s full and fair cash value, the price a willing seller and a willing buyer would agree to in an “arm’s-length” transaction. Quincy ensures that property owners pay only their fair share of the City’s tax burden by doing its best to accurately determine each property’s full and fair cash value.

Property valuation can be thought of in two distinct phases - data collection and valuation and analysis. Data collection occurs continuously throughout the year; the assessor performs valuation and analysis in the fall.

Once the Department of Revenue certifies the property values, the assessor calculates the final property taxes each property owner owes; the third quarter and fourth quarter property tax bills contain the final property value and final taxes owed. To learn more about how property taxes are calculated, please see “How Property Taxes Are Calculated For Individual Properties” (page 12).

Property valuation can be thought of in two distinct phases - data collection and valuation and analysis. Data collection occurs continuously throughout the year; the assessor performs valuation and analysis in the fall.

Once the Department of Revenue certifies the property values, the assessor calculates the final property taxes each property owner owes; the third quarter and fourth quarter property tax bills contain the final property value and final taxes owed. To learn more about how property taxes are calculated, please see “How Property Taxes Are Calculated For Individual Properties” (page 12).

Are you interested in learning more about Tax Valuation?

To learn more about real and personal property taxes, check out page 5 of the Understanding Your Taxes Brochure. This informative guide explains the calculation of taxes and highlights their significance for the City of Quincy.

To learn more about real and personal property taxes, check out page 5 of the Understanding Your Taxes Brochure. This informative guide explains the calculation of taxes and highlights their significance for the City of Quincy.

OTHER QUESTIONS

For questions on property valuation, please contact us on (617)376-1170 or message us.