Tax Bills On A Quarterly Basis

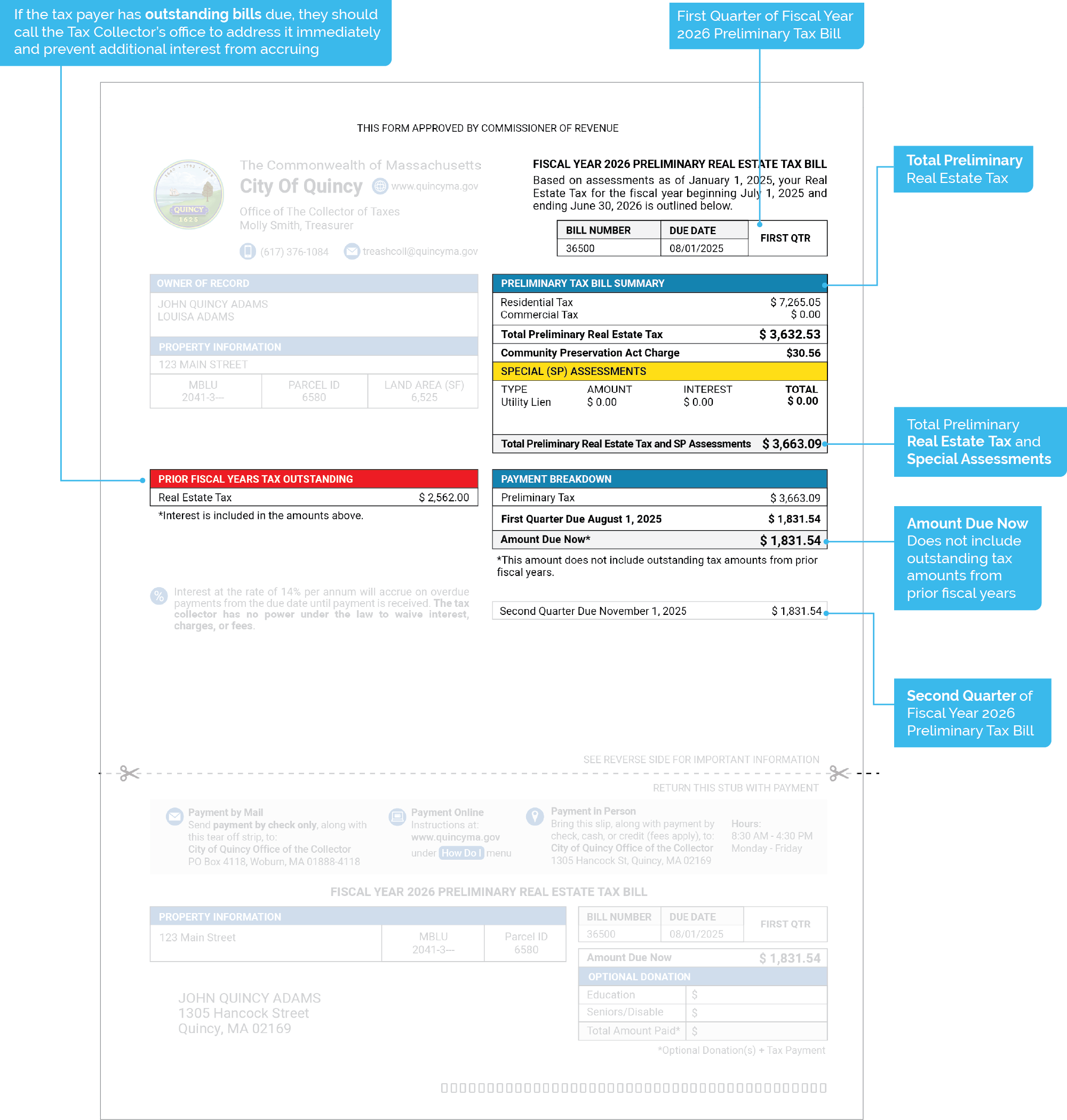

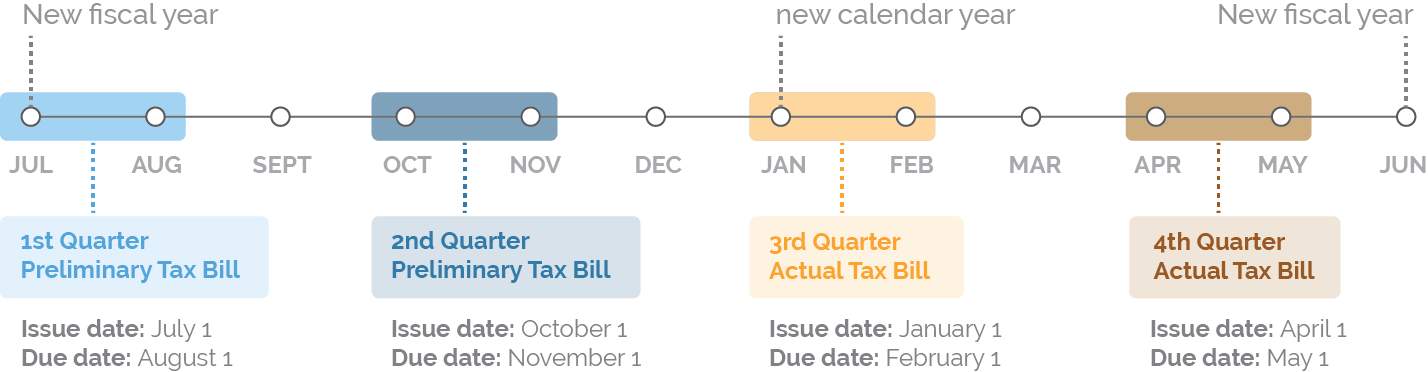

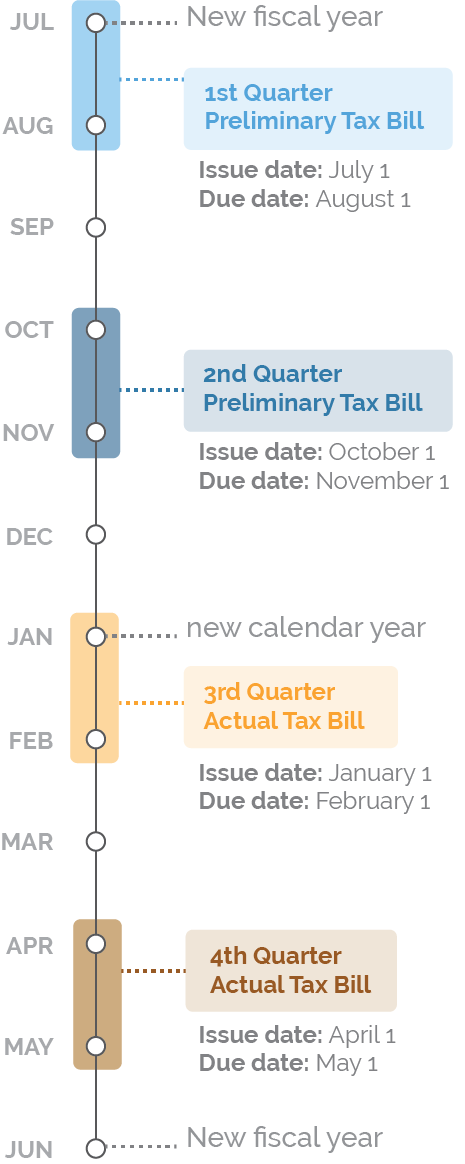

The first quarter and second quarter bills reflect the preliminary taxes due for the new fiscal year. The total preliminary tax due is approximately 50% of the prior year’s total property tax. The total amount of preliminary tax owed on the property is split into two equal payments, with the first payment due August 1 (first quarter) and the second payment due November 1 (second quarter).

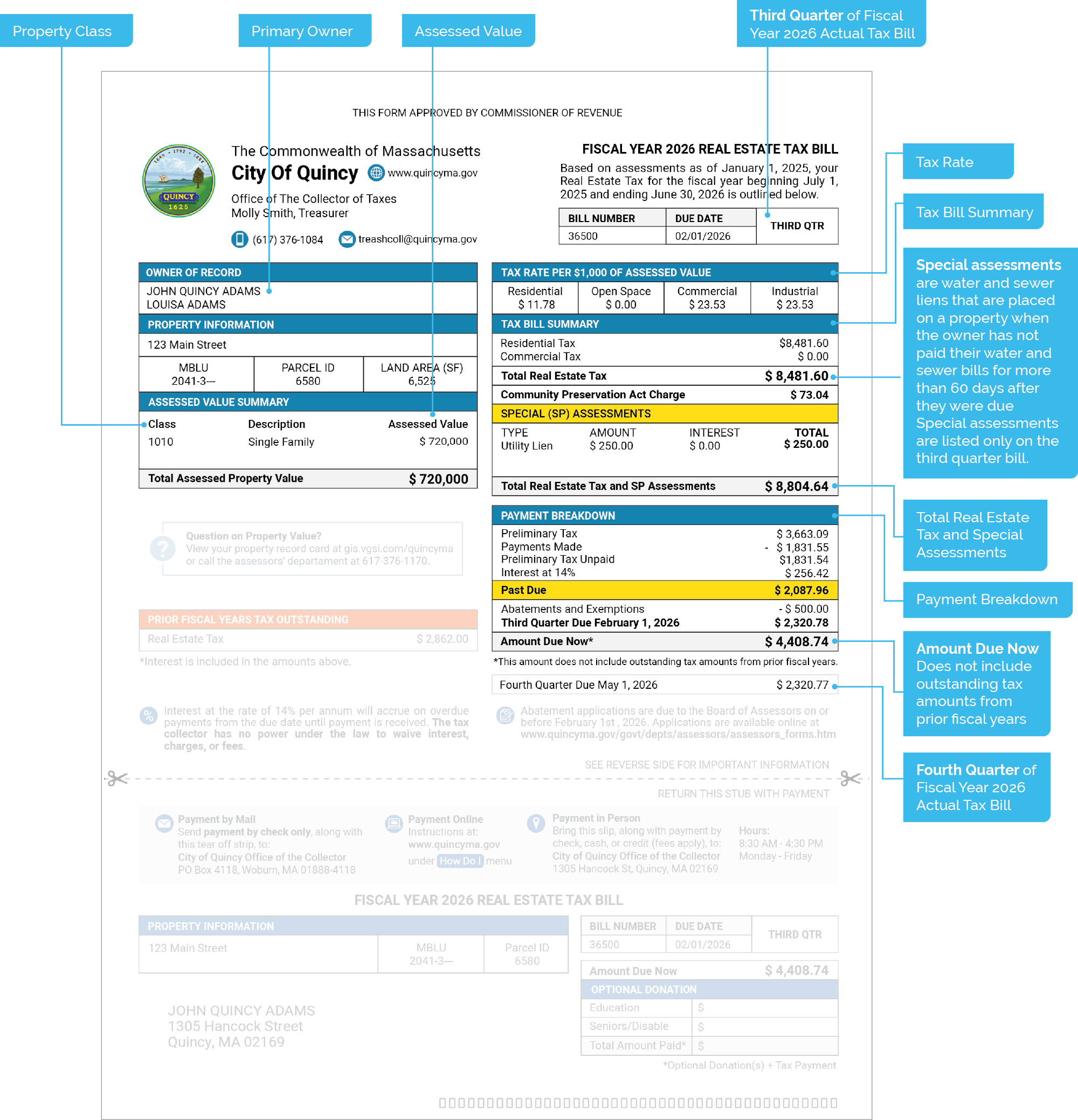

The third quarter and fourth quarter bills reflect the full and fair cash assessed value of the property, the tax rate for the fiscal year, and the entire tax owed on the property, less the preliminary payments made in the first and second quarter of the fiscal year. The amount due is split into two equal payments, with the first payment due February 1 (third quarter) and the second payment due May 1 (fourth quarter).

Data collected during a property visit is updated in the assessor’s valuation system. An updated property card appears on the https://gis.vgsi.com/quincyma website on January 1 following the property visit; the new property valuation appears on the third quarter tax bill, which comes out in January.

Tax Bills Quarterly Basis

Data collected during a property visit is updated in the assessor’s valuation system. An updated property card appears on the https://gis.vgsi.com/quincyma website on January 1 following the property visit; the new property valuation appears on the third quarter tax bill, which comes out in January.

The first quarter and second quarter bills reflect the preliminary tax due before the new fiscal year begins. The total preliminary tax due is 50% of the prior year’s tax. The total amount of preliminary tax owed on the property is split into two equal payments, with the first payment due on August 1 and the second payment due November 1.

The third quarter and fourth quarter bills reflect the calculated full and fair cash value assessment of the property, the tax rate for the fiscal year, and the entire tax owed on the property, less the preliminary payments made in the first half of the fiscal year and any exemptions applied to the property. The net amount due is split into two equal payments, with the first payment due on February 1 and the second payment due May 1.

Real Estate Tax Bill Examples

Below are examples of the preliminary and actual real estate tax bills.